michigan use tax act

Notice of New Sales Tax Requirements for Out-of-State Sellers. The Michigan General Sales Tax Act took effect June 28 1933.

Enrolled House Bill No 4002 Michigan Legislature State Of

While the burden of paying.

. AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state. USE TAX ACT Act 94 of 1937. As of March 2019 the Michigan Department of Treasury offers.

That Checkpoint was prewritten computer software subject to a tax when plaintiffs Michigan. USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or. Imposition of the Tax.

AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal property and certain. This act shall be known and may be cited as the city income. 20593a Tax for use or consumption.

The Michigan Use Tax Act Sec. Guardian Indus Corp v Dept of Treasury 243 Mich App 244 248. Here in Michigan if you purchase tangible personal property for use in Michigan you have to either pay sales tax to the seller or pay whats called a use tax to the state.

An on-time discount of 05 percent on the first 4 percent of the tax. However credit is given for any sales or use tax that had been legally due and paid in another state of the. The People of the State of Michigan enact.

The People of the State of Michigan enact. 31 MCL 20593 provides. 621 NW2d 450 2000.

MCL 20591 Use tax act. Act 167 of 1933. This act may be cited as the Use Tax Act.

USE TAX ACT A. The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. USE TAX ACT Act 94 of 1937.

The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. CHAPTER 1 GENERAL PROVISIONS 141501 City income tax act. Provisions in the recently passed.

The People of the State of Michigan enact. 23 hours agoMichigan-based startup Our Next Energy revealed plans to invest 16 billion in a battery cell manufacturing plant just outside of Detroit. GENERAL SALES TAX ACT.

The People of the State of Michigan enact. Telecommunications - Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone. The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931.

Act 94 of 1937. Purpose other than for resale or for lease if the rental receipts are taxable under the use tax act 1937 PA 94 MCL 20591 to 205111 in the form of tangible personal property to a person. Minimum 6 maximum 15000 per.

Charges for intrastate telecommunications services or telecommunications services between state and another state. Sales for resale government purchases and isolated sales were exemptions originally included in the Act. STANDARD OF REVIEW We review de novo a Court of Claims grant of summary disposition.

The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Streamlined Sales and Use Tax Project.

Understanding Use Tax In Michigan Shindelrock

Michigan S New Internet Sales Tax Law Takes Effect Wdet 101 9 Fm

New Tax Law Could Help First Official Michigan Wwii Memorial Get Off The Ground

Proposal 1 Asks Michigan Voters To Weigh In On A Complex Tax Issue

Michigan Sales Tax Guide For Businesses

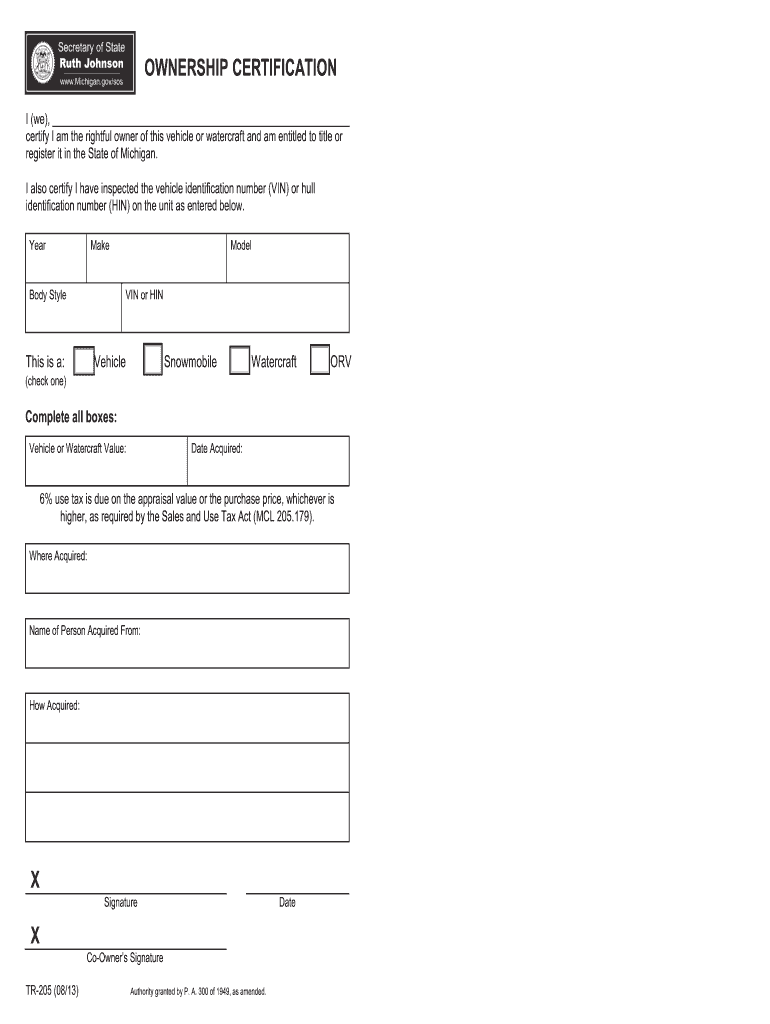

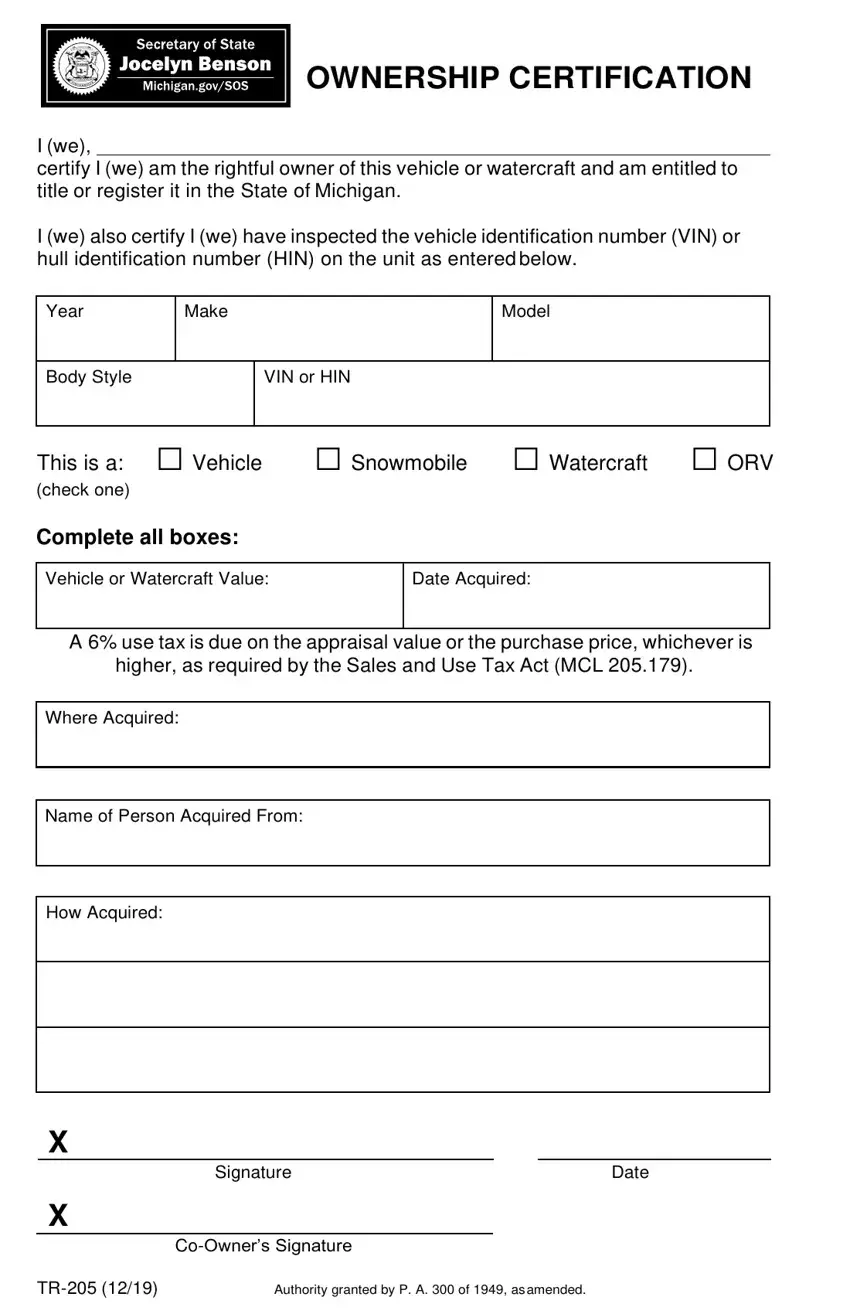

Printable Michigan Tr205 Fill Out Sign Online Dochub

Communities In Michigan That Have Opted In To Adult Recreational Use

Fillable Online Legislature Mi Www Legislature Mi Govmcl Act 188 Of 1899michigan Estate Tax Act Michigan Legislature Home Fax Email Print Pdffiller

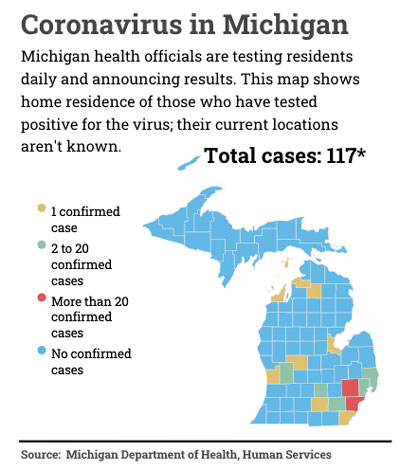

Covid 19 Update Federal Government Debuts Families First Coronavirus Response Act Michigan Extends Tax Deadline And More Dbusiness Magazine

New Michigan Flow Through Entity Tax Putting It To Work For You Doeren Mayhew Cpas

Historic Personal Income Tax Citizens Research Council Of Michigan

Sales Tax Laws By State Ultimate Guide For Business Owners

Property Tax Archives Michigan Property Tax Law

State Amends Tax Act To Benefit Flow Through Entities Corp Magazine

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Tr 205 Form Fill Out Printable Pdf Forms Online

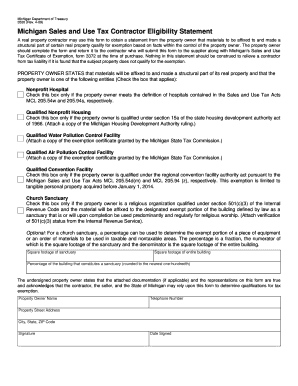

Fillable Online Mi 3520 Michigan Sales And Use Tax Contractor Eligibility Statement Mi Fax Email Print Pdffiller